Pay Freeze Locks in Historically High Gov't Wages

Bill Wilson is the President of Americans for Limited Government.

The Week Ahead, Featuring Big Government Bozo of the Week

The Misguided Economics of Small Business Saturday

Kevin Dayhoff - Soundtrack Division of Old Silent Movies - www.kevindayhoff.net - Runner, writer, artist, fire and police chaplain. The mindless ramblings of a runner, journalist, and artist: National and International politics. For community see www.kevindayhoff.org. For art, writing and travel see www.kevindayhoff.com

May 18th, 2010

All Original Content Open Source & Copyright Free

Corker on Dodd financial takeover bill: "I realize this bill is going to pass."

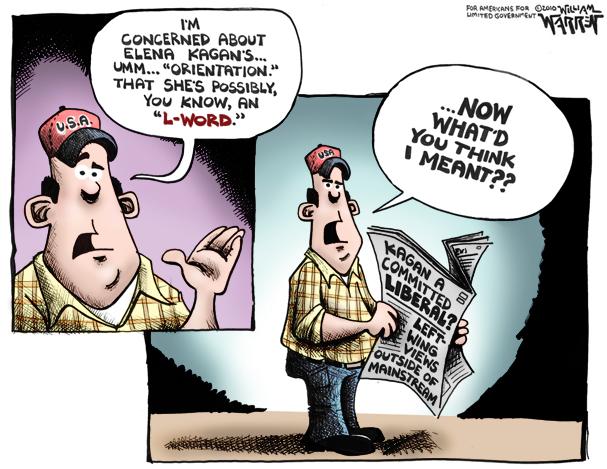

There are perfectly legitimate policy grounds under which to oppose Elena Kagan for the Supreme Court.

Video: Hilda Solis' Price is Right

Obama Labor appointees get massive pay raises.

IBD Editorials: Guess What Greece Has To Jettison?

Government-run health care must be repealed as a condition for the IMF-EU bailout.

Republicans Roll Over?

By Robert Romano

Rescinding government control of the nation's financial sector — along with repealing ObamaCare and restoring fiscal sanity to the nation's budget — all may have to be put off for some time after elections have taken place. And put onto the American people's "to-do" list in 2011 and beyond. If ever. Why?

Sadly, instead of rolling back another government takeover, this time of the financial system, enough Senate Republicans have apparently rolled over and are letting it through.

Consider Republican Senator Bob Corker's admission that efforts to defeat the Dodd financial takeover bill have apparently always been doomed to failure, as reported by the Washington Post. Although indicating he opposed the legislation, Corker said, "I realize this bill is going to pass." He described the legislation as "an out-of-the-park home run" achievement for the Obama Administration.

That can only mean one thing: that while critical negotiations were taking place, Republicans took the credible threat of a filibuster off the table. Which, in turn, would explain why they have failed to achieve any concessions that might have addressed some of the root, government causes of the financial crisis.

For example, Senator John McCain's amendment to end the ongoing taxpayer bailout of Fannie Mae and Freddie Mac could have been dubbed a deal-breaker for the Senate GOP. That without it, there would be a filibuster. So too could have Senator David Vitter's amendment to audit the Federal Reserve. Or demands could have been made that the Department of Housing and Urban Development's "affordable housing goals" imposed on Fannie and Freddie be ended, its loose-lending Community Reinvestment Act regulations be repealed, and the Federal Housing Administration's weakening of down payments on home mortgages eliminated.

None of these very reasonable concessions were achieved. And the only explanation is that all 41 Senate Republicans proved incapable of sticking together to fight for the American people.

Even the concessions that were reportedly achieved were not really. Take the alleged removal of an unlimited bailout fund in the Dodd-Shelby amendment.

Under the Dodd-Shelby amendment, any monies "necessary to initiate and continue operations essential to the implementation of the receivership or any bridge financial company" would be pulled out of an unlimited "orderly liquidation fund" without necessarily being recouped. As Americans for Limited Government (ALG) reported in an updated bill summary on the issue, that's a bailout.

So, despite the political catastrophe of the Troubled Asset Relief Program, and the bailouts of Fannie, Freddie, AIG, GM, and Chrysler all under a Republican administration, the Senate — with the help of a "handful of GOP members" reported by the Post — is now poised to institutionalize that authority for all time.

How could this happen? In part, claims made by the Senate about the Dodd-Shelby "compromise" were not properly vetted, which then provided political cover to moderates looking for a reason to vote for the bill.

According to the preamble of the Dodd-Shelby amendment, it would "end 'too big to fail' [and] protect the American taxpayer by ending bailouts." It does neither. When it passed 93 to 5, even though no language was yet available for public perusal, media outlets across the nation uncritically reported that the Dodd-Shelby amendment eliminated bailouts. Even the National Review reported that the bailout fund was removed — when it was not.

So, why go on pretending that it is?

ALG President Bill Wilson has been a voice in the wilderness on this issue. Last week, speaking of the amended bill, he said, "Nothing has substantively changed. Despite the efforts of Senate Republicans, the orderly liquidation fund still has not been removed. After all the amendments voted on, the government can still seize any institution it wants, and then keep it, reorganize it, or redistribute it without any Congressional approval."

What remains to be seen is if Senate Republicans will do anything about it. Or, if they'll just roll over and pretend that they've solved "too big to fail" and eliminated bailouts. The American people deserve better than this.

Robert Romano is the Senior Editor of ALG News Bureau.

http://blog.getliberty.org/

The L-Word

ALG Editor's Note: William Warren's award-winning cartoons published at GetLiberty.org are a free service of ALG News Bureau. They may be reused and redistributed free of charge.

http://blog.getliberty.org/

Video: Hilda Solis' Price is Right

ALG Editor's Note: In the following featured video produced by Americans for Limited Government's Andrius Vaitekunas, Obama Labor appointees get massive pay raises:

http://blog.getliberty.org/

Guess What Greece Has To Jettison?

Policy Failure: Greece was told that if it wanted a bailout, it needed to consider privatizing its government health care system. So tell us again why the U.S. is following Europe's welfare state model.

The requirement, part of a deal arranged by the IMF, the European Union and the European Central bank, is a tacit admission that national health care programs are unsustainable. Along with transportation and energy, the bailout group, according to the New York Times, wants the Greek government to remove "the state from the marketplace in crucial sectors."

This is not some cranky or politically motivated demand. It is a condition based on the ugly reality of government medicine. The Times reports that economists — not right-wingers opposed to health care who want to blow up Times Square — say liberalizing "the health care industry would help bring down prices in these areas, which are among the highest in Europe."

Of course most of the media have been largely silent about the health care privatization measure for Greece, as it conflicts with their universal, single-payer health care narrative.

The public health system in the Hellenic Republic is operated by the Ministry of Health and Welfare, where centralized decisions and rules are made.

It provides free or low-cost treatment through what is essentially a single-payer system established in 1983 when the Socialist Party was in power. Family members and retirees are also covered. Like the systems in Britain and Canada, it has agonizingly long waiting lists.

It should be no surprise that in Greece, health care spending as a percentage of the economy is relatively steep. According to Organization for Economic Co-operation and Development data, it's higher than that in the Netherlands, Italy, Spain, the United Kingdom and Japan. Despite all the spending, Greece could never cover 100% of its citizens, reaching only about 83% for primary care.

Today, the patient most in need of a room in the intensive-care ward is Greece itself — what with government debt nearing 120% of GDP and the deficit at 13% of GDP.

The mere possibility of government spending cuts sent striking workers and public employees into the streets. Groups upset with the budget cuts have protested, rioted, looted and killed.

On May 5, three died in a bank fire fueled by a Molotov cocktail during a riot against the austerity measures that have been intended to save the government from bankruptcy and, as well, secure aid from other nations.

http://blog.getliberty.org/

*****

Kevin Dayhoff Soundtrack: http://kevindayhoff.blogspot.com/ = http://www.kevindayhoff.net/ Kevin Dayhoff Art: http://kevindayhoffart.blogspot.com/ or http://kevindayhoffart.com/ = http://www.kevindayhoff.com/ Kevin Dayhoff Westminster: http://kevindayhoffwestgov-net.blogspot.com/ or http://www.westgov.net/ = www.kevindayhoff.org Twitter: https://twitter.com/kevindayhoff Twitpic: http://twitpic.com/photos/kevindayhoff Kevin Dayhoff's The New Bedford Herald: http://kbetrue.livejournal.com/ = www.newbedfordherald.net Explore Carroll: www.explorecarroll.com The Tentacle: www.thetentacle.com